CFO-Level Financial Ownership, Without Adding Internal Headcount

We take responsibility for the finance function for Australian businesses doing roughly $2M to $30M in revenue that want clearer numbers, tighter control, and better financial decisions, without building an internal finance team.

Outsourced CFO Ownership, supported by robust financial systems

We provide outsourced CFO ownership, supported by institutional-grade financial systems.

We sit above the books, not inside them.

We take responsibility for forecasting, cash discipline, reporting cadence, and financial decision support, so decisions are made deliberately rather than on instinct.

Behind the scenes, we put in place and maintain the systems a capable internal CFO would typically build over time: driver-based forecasts, rolling cashflow control, and reporting management actually uses.

Delivered without adding internal headcount.

Transactional accounting and tax execution sit outside our scope and are coordinated with your existing team or external providers.

Measured Impact

Released from working capital in 45 days:

DSO −12, DPO +9.

Forecast variance

over 90 days after driver rebuild.

Gross margin

improvement after pricing and mix correction.

Source: aggregated, anonymised client outcomes. Measured from live systems and operating cadence, not forward projections.

Core Systems

The baseline finance system we put in place and maintain for every client.

Forecasting

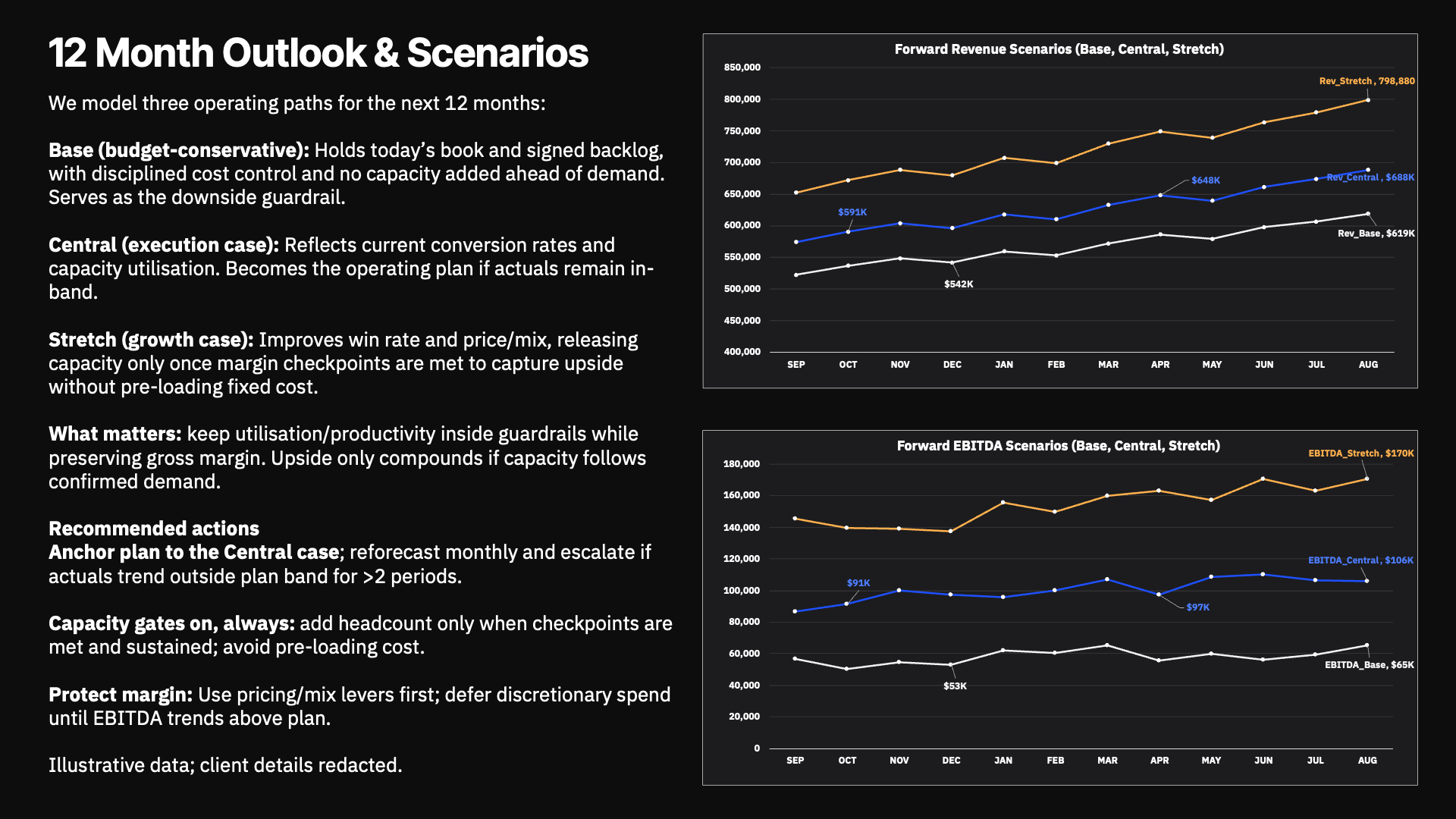

Rolling, driver-based forecasts with scenarios tied to how the business actually behaves.

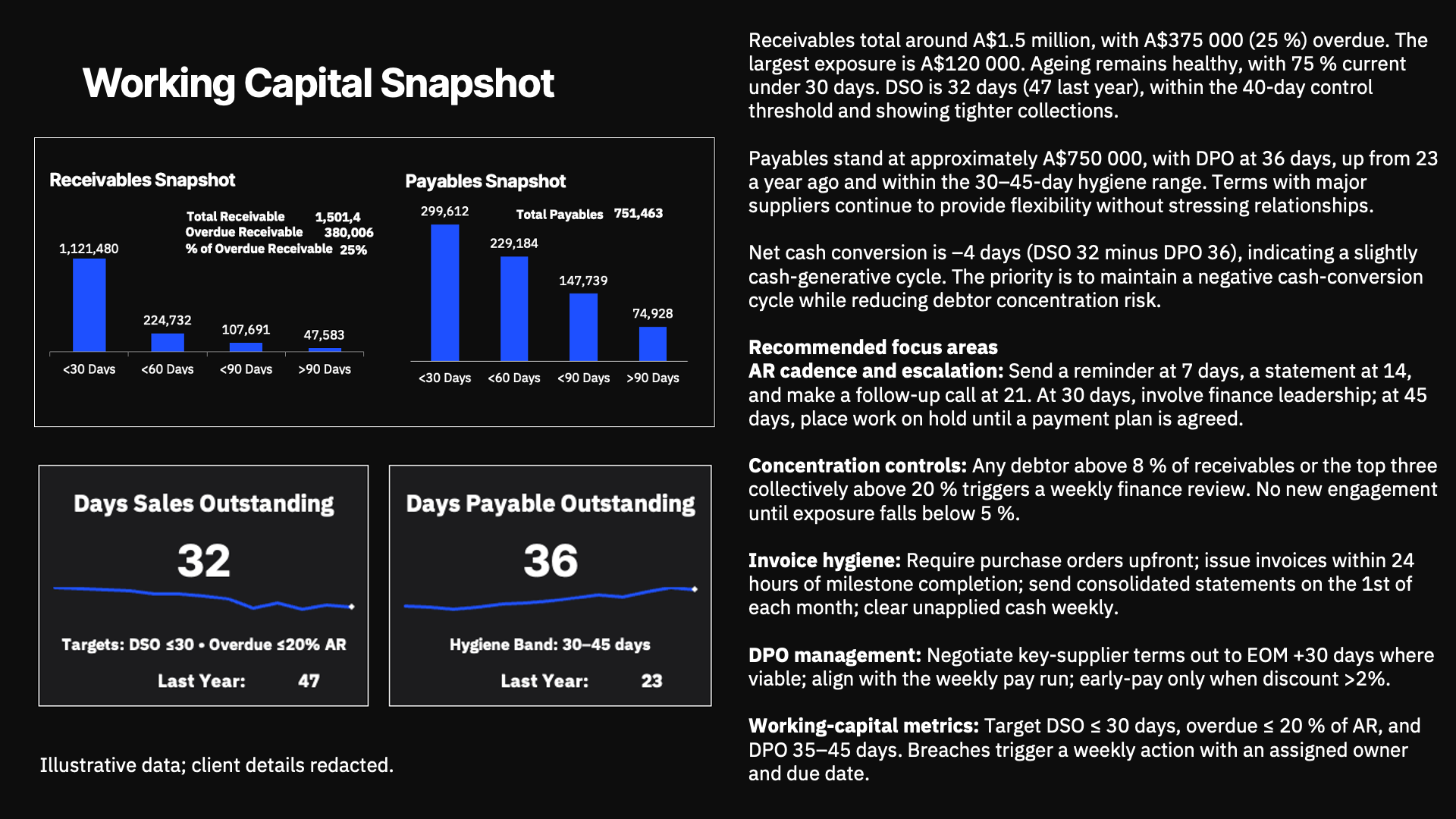

Cashflow

13-week cashflow control with clear levers, triggers, and intervention rules.

Board Reporting

Monthly packs with variance analysis, margin drivers, and forward risk signals.

Decision Support

CFO-level financial input into pricing, hiring, capital allocation, and material trade-offs.

Delivery Model

We take ownership in three stages:

Diagnose

A short, structured diagnostic benchmarking your current finance function against CFO standards. We identify blind spots in decision-making, hidden cash risk, and where reporting breaks down.

Build

We install the required systems: forecasts, cashflow, and reporting, aligned into a single operating cadence.

Run

Ongoing CFO-level oversight. We maintain the models, run the reporting rhythm, monitor cash and performance, and act as the financial counterweight in leadership decisions.